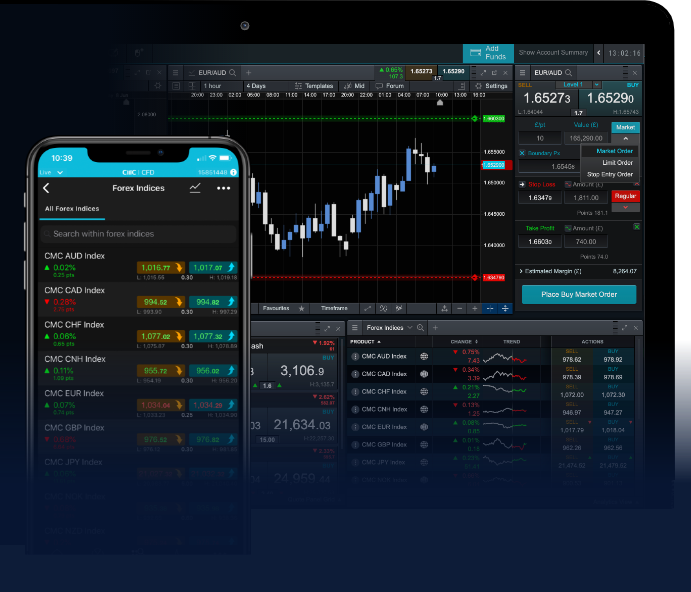

In recent years, the foreign exchange (Forex) market has seen a remarkable transformation, largely due to the introduction and advancement of Forex trading bots. These automated systems have redefined how traders engage with the market, offering efficiency, speed, and a level of convenience that manual trading often cannot match. Whether you are a seasoned trader or a novice, understanding Forex trading bots and their functionality can significantly enhance your trading experience. If you are looking for reliable platforms to access these trading robots, consider checking forex trading bot Trusted Trading Brokers.

What are Forex Trading Bots?

Forex trading bots, also known as automated trading systems or expert advisors (EAs), are software programs that automatically execute trades on behalf of a trader based on predefined algorithms and market conditions. These bots are designed to analyze market data, identify trading opportunities, and execute trades at optimal times, all without human intervention. They can operate on various trading strategies, including scalping, day trading, and swing trading, making them versatile tools for different trading styles.

How Do Forex Trading Bots Work?

The functionality of Forex trading bots hinges on algorithms that utilize technical analysis and specific trading strategies. Traders can program these bots to consider various indicators and signals when making trading decisions. For example, a bot might be programmed to buy a currency pair when the Relative Strength Index (RSI) indicates an oversold condition and sell when it indicates overbought conditions. This kind of automated decision-making allows traders to act quickly on opportunities without the emotional biases that often accompany manual trading.

Advantages of Using Forex Trading Bots

- Emotionless Trading: One of the primary benefits of using trading bots is their ability to eliminate emotional decision-making. Traders often struggle with fear and greed, which can lead to poor trading decisions. Bots stick to their programmed strategies, ensuring consistency.

- 24/5 Trading: Forex trading operates 24 hours a day, five days a week. Bots can monitor the market continuously, executing trades at any time, even when the trader is not actively involved. This allows for the capture of profitable opportunities that may arise during off hours.

- Speed and Efficiency: Bots can process vast amounts of data in seconds and execute trades much faster than a human can react. This speed is critical in Forex trading, where even a slight delay can result in lost profit.

- Backtesting Capabilities: Most trading bots come with backtesting features, allowing traders to test their strategies on historical data. This helps traders understand how a strategy might perform in various market conditions before risking real capital.

- Customizable Strategies: Traders can tweak and adjust their bots according to their preferred trading strategies, risk tolerance, and market conditions. This flexibility aids in tailoring the trading experience to individual preferences.

Challenges and Risks of Forex Trading Bots

While Forex trading bots offer significant advantages, they are not without their challenges and risks. Traders should be aware of the following considerations:

- Market Volatility: The Forex market is inherently volatile, and bots, while sophisticated, can struggle to adapt to sudden price movements. A poorly designed bot can incur substantial losses in turbulent market conditions.

- Dependence on Technology: Technical issues, such as internet outages, power failures, or software glitches, can hinder a bot’s performance. Traders must ensure reliable infrastructure to mitigate these risks.

- Over-Optimization: There is a risk of overfitting a bot to historical data, which may lead to poor real-world performance. Traders should maintain a level of skepticism and continuously monitor their bots’ performance.

- Market Manipulation: In some instances, bots may be vulnerable to market manipulation practices, which could jeopardize their effectiveness. Ensuring that the bot uses reliable data sources is critical for maintaining performance.

How to Choose the Right Forex Trading Bot

Selecting the appropriate Forex trading bot requires careful consideration of several factors:

- Reputation and Reviews: Researching the bot’s reputation through user reviews and feedback can provide insight into its effectiveness and reliability.

- Performance Metrics: Look for bots with transparent performance metrics. A good trading bot should provide detailed reports on profitability and risk parameters.

- Customer Support: Adequate customer support is essential to help resolve technical issues or answer questions when using the bot. Ensure that the provider offers timely assistance.

- Customization Options: Ideal bots should allow for a degree of customization so that traders can adjust settings to fit their personal strategies and risk profiles.

- Cost: Some bots charge a subscription fee, while others take a percentage of profits. Understanding the cost structure upfront can prevent unexpected expenses later.

Combining Trading Bots with Human Expertise

While Forex trading bots can enhance trading efficiency, they should not replace the need for human expertise. Effective trading often requires an understanding of market dynamics, fundamental analysis, and sentiment indicators. Utilizing a trading bot in conjunction with a trader’s insights and judgment can lead to even greater success. Many successful traders adopt a hybrid approach, leveraging bots to handle routine tasks while they focus on strategy development and market analysis.

Conclusion

Forex trading bots are revolutionizing the way traders participate in the FX market. With the ability to execute trades automatically based on algorithms, these tools offer efficiency, speed, and the elimination of emotional biases. While they come with their own set of challenges and risks, when utilized correctly, Forex trading bots can significantly enhance a trader’s capabilities. As technology continues to evolve, so too will the tools available to traders, making it a thrilling time to be involved in Forex trading.