The Ultimate Guide to Forex Market Trading Hours

The Forex market operates 24 hours a day, five days a week, enabling traders to engage in currency trading from anywhere in the world. Understanding the trading hours is crucial for traders looking to optimize their strategies. The Forex market is divided into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. Each session offers unique opportunities and differing levels of market volatility. For comprehensive insights and resources, don’t forget to check out forex market trading hours Best Jordanian Brokers.

Understanding Forex Trading Hours

The global Forex market is decentralized, meaning there is no physical location where transactions take place, unlike stock markets. Instead, the Forex market is made up of a network of banks, brokers, financial institutions, and individual traders. As such, it operates 24 hours a day, beginning with the Sydney session and ending with the New York session.

Forex Trading Sessions

Each trading session has its own characteristics, and knowing when these sessions overlap is vital for traders seeking to capitalize on major price movements.

1. Sydney Session

The Sydney session begins at 10 PM GMT and runs until 7 AM GMT. It is usually the least volatile session, but it can provide some opportunities, especially when major economic data is released in Australia. The opening of this session marks the start of the trading week. Traders often see a gradual increase in activity as the session progresses.

2. Tokyo Session

The Tokyo session follows the Sydney session and runs from 12 AM GMT to 9 AM GMT. This session entails increased market activity and can result in significant price movements. The trading volumes during the Tokyo session tend to be higher due to the participation of institutional investors, including banks and major financial corporations.

3. London Session

The London session is often considered the most important session for Forex traders. This session opens at 7 AM GMT and closes at 4 PM GMT. The London session is known for high volatility and increased trading volume, making it a prime window for executing trades. Many economic reports are released during this session, which can lead to notable price fluctuations in currency pairs.

4. New York Session

The New York session runs from 12 PM GMT to 9 PM GMT. It is marked by high liquidity, especially in currency pairs that involve the US dollar. The overlap between the London and New York sessions is especially significant for traders, as it provides the highest volume of trading activity. Many traders often wait for this overlapping period to execute their trading strategies.

Overlap Between Trading Sessions

One of the crucial aspects of the Forex market is the overlap between trading sessions. This overlap tends to produce the most trading activity and volatility, which can create opportunities for traders. The two main overlaps worth noting are:

1. London and New York Overlap

The overlap between the London and New York sessions occurs from 12 PM to 4 PM GMT. This is typically the busiest period in the Forex market, with traders seeing increasingly sharp price movements due to the influx of liquidity. Most professional traders prefer to execute trades during this time due to the heightened volatility and the potential for higher profits.

2. Sydney and Tokyo Overlap

Another notable overlap is between the Sydney and Tokyo sessions, from 12 AM to 7 AM GMT. While not as busy as the London/New York overlap, activities during this period can be influenced by Australian and Japanese economic releases.

Best Times to Trade in Forex

Choosing the best time to trade Forex can significantly impact a trader’s success. When times overlap between sessions, the market tends to experience the highest trading volume and the most significant price fluctuations. Given that most traders seek to capitalize on such market movements, the following times are generally considered optimal:

- 12 PM to 4 PM GMT (London/New York Overlap)

- 12 AM to 7 AM GMT (Sydney/Tokyo Overlap)

Factors Influencing Forex Trading Hours

While the Forex market is open 24 hours, several factors can still influence trading hours, including:

- Major Economic Events: Key announcements (e.g., unemployment data, interest rate changes) can lead to increased volatility. Traders tend to keep a close eye on the economic calendar.

- Market Sentiment: Geopolitical developments and market news can influence trader sentiment and lead to significant trades being executed during specific hours.

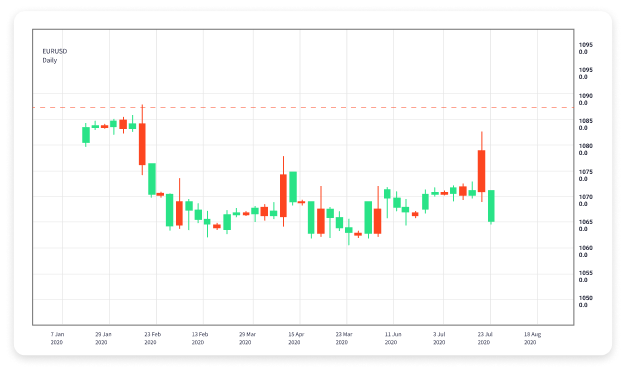

- Major Currency Pairs: Certain currency pairs tend to be more active during specific sessions. For example, the EUR/USD pair is typically more liquid during the London session.

Conclusion

Understanding Forex market trading hours is essential for any trader looking to maximize their potential for profits. Each trading session offers unique opportunities, and knowing when to trade can significantly affect trading outcomes. By being aware of the overlaps between sessions and the economic events that can impact market behavior, traders can formulate strategies that align with peak trading times. Remember always to keep abreast of the market news and adhere to a well-structured trading plan to navigate the Forex market successfully.